Vision

Focus on fundamentally strong businesses, target assets with overestimated risks by the market.

It also reduces the controllable risks of the holding process, thus obtaining the expected excess return.

It also reduces the controllable risks of the holding process, thus obtaining the expected excess return.

Strategy

Emphasize the long-term fair value of investments while using financial instruments to manage short-term downside risks.

We avoid crowded trades and steer clear of herd behavior.

We avoid crowded trades and steer clear of herd behavior.

Vision

Focus on fundamentally strong businesses, target assets with overestimated risks by the market, and minimize controllable risks during holding to achieve predictable excess returns.

Strategy

We focus on investing in enterprises with reasonable long-term value, and also control short-term downside risks through various financial instruments. We don't go to crowded places, and naturally we don't follow people.

PERFORMANCE

investment PERFORMANCE METRICS

0

%

Cumulative Return

Cumulative Return

0

%

Annualized Return

Annualized Return

0

%

Max Drawdown

Max Drawdown

0

MAR ratio

MAR ratio

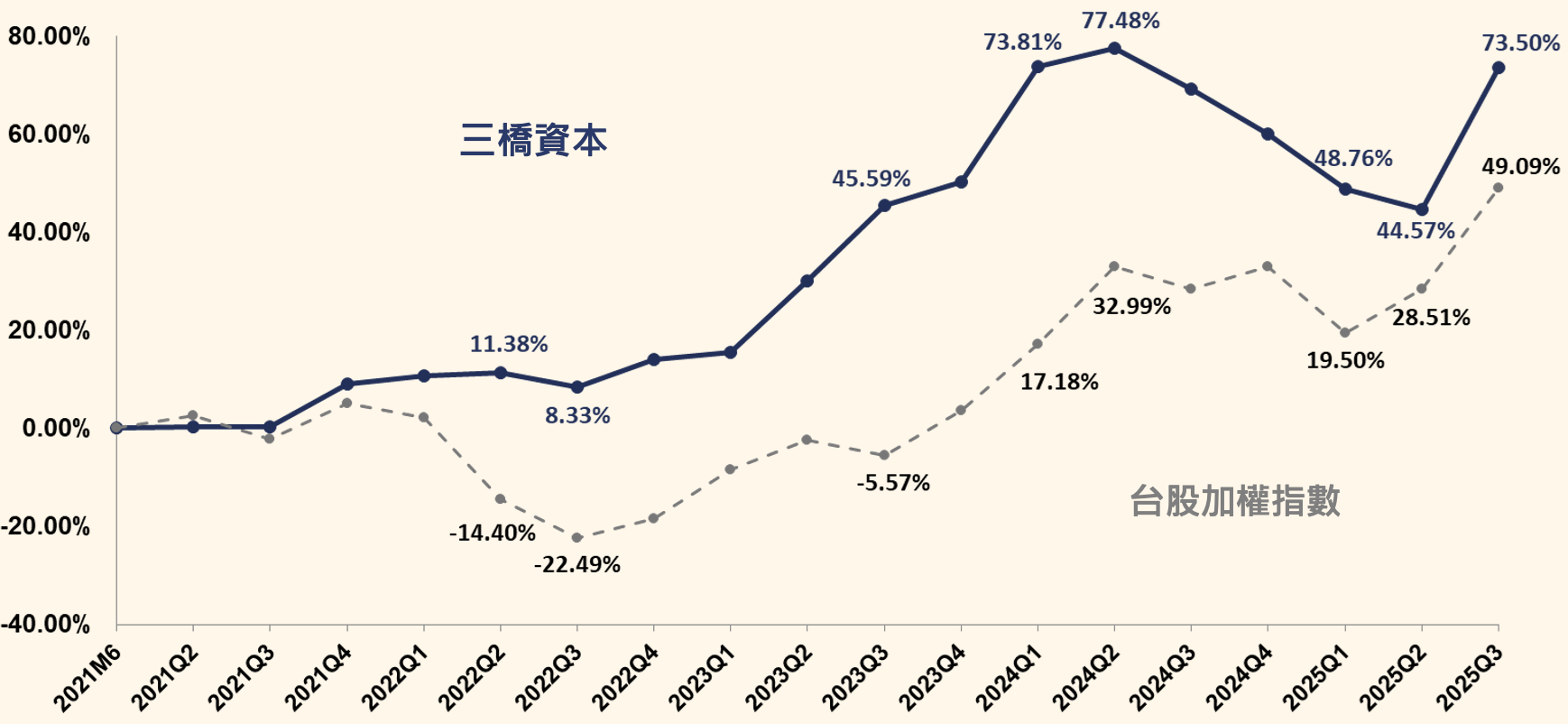

- Accumulated 4.5 years since inception, outperforming the broader market by 24.4% over the same period (as of Q3 2025)

- Maximum Drawdown (MDD): This represents the largest loss experienced by the company, measured as the decline in net asset value from its peak to its lowest point.

- MAR Ratio: Annualized Return/Maximum Drawback (MDD), about 0.32 for Polkshire, 0.12 for S&P 500, 0.17 for Taiwan Weighted Index, and 0.07 for ARKK.

How We Do

Secondary Market

Use value investing and risk management to capture price differentials.

Primary Market

(Investing in scalable cash flow businesses)

Identify potential opportunities and actively participate in core operations

to share in the gains.

Sharing of Views

Articles

Contact Us

Please leave your Name, Company & Title, Your Questions. Thank you.

Almost a month

0

%

Last three months

0

%

So far this year

0

%

last year

0

%

since its establishment

0

%

Net value per share

0

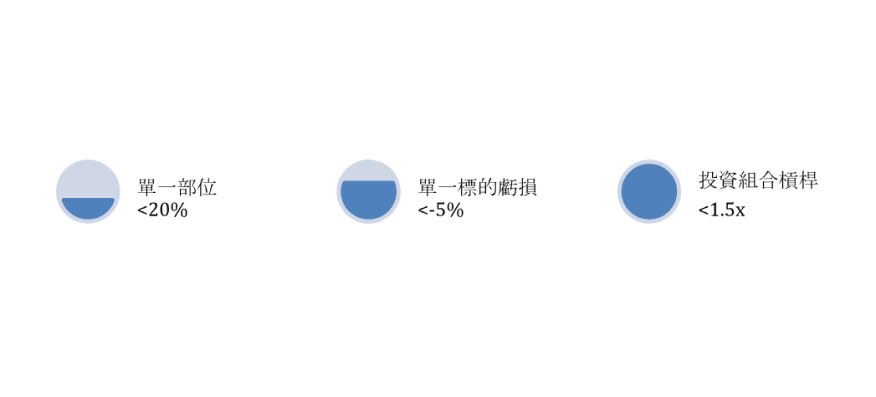

Mitsukoshi's top priorities for capital allocation

That is, to look for overvalued risks.

and minimize the controllable risks under the chosen scenario.